Products

distinct

Data Sets

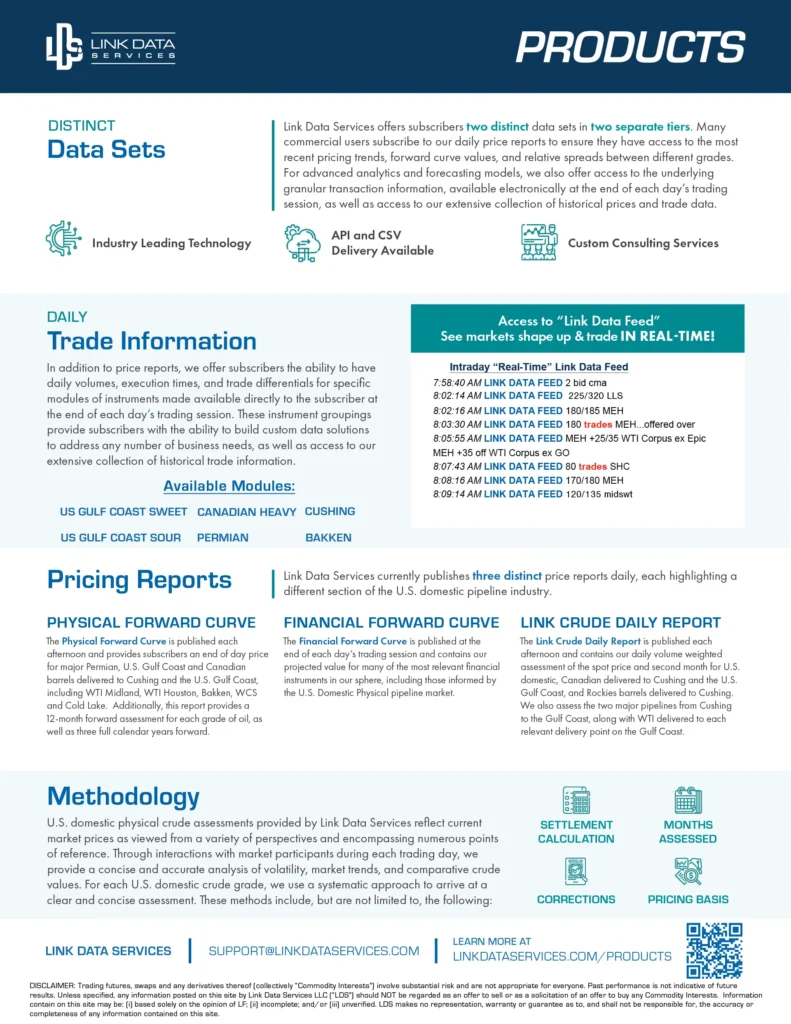

Link Data Services offers subscribers two distinct data sets in two separate tiers. Many commercial users subscribe to our daily price reports to ensure they have access to the most recent pricing trends, forward curve values, and relative spreads between different grades. For advanced analytics and forecasting models, we also offer access to the underlying granular transaction information, pushed electronically at the end of each day’s trading session, as well as access to our extensive collection of historical prices and trade data.

Industry Leading

Technology

API, CSV, and FTP

Delivery Available

Custom Consulting Services

Our consultants provide customized research and planning, market education, as well as bespoke data solutions.

Pricing Reports

Link Data Services currently publishes three distinct price reports daily, each highlighting a different section of the U.S. domestic pipeline industry.

Physical Forward Curve

The Physical Forward Curve is published each afternoon and provides subscribers an end of day price for major Permian, U.S. Gulf Coast and Canadian barrels delivered to Cushing and the U.S. Gulf Coast, including WTI Midland, WTI Houston, Bakken, WCS and Cold Lake. Additionally, this report provides a 12-month forward assessment for each grade of oil, as well as three full calendar years forward.

Financial Forward curve

The Financial Forward Curve is published at the end of each day’s trading session and contains our projected value for many of the most relevant financial instruments in our sphere, including those informed by the U.S. Domestic Physical pipeline market.

Link crude daily report

The Link Crude Daily Report is published each afternoon and contains our daily volume weighted assessment of the spot price and second month for U.S. domestic, Canadian delivered to Cushing and the U.S. Gulf Coast, and Rockies barrels delivered to Cushing. We also assess the two major pipelines from Cushing to the Gulf Coast, along with WTI delivered to each relevant delivery point on the Gulf Coast.

Daily

Trade Information

In addition to price reports, we offer subscribers the ability to have daily volumes, execution times, and trade differentials for specific modules of Instruments pushed directly to the subscriber at the end of each day’s trading session. These instrument groupings provide subscribers the ability to build custom data solutions to address any number of business needs, as well as access to our extensive collection of historical trade information.

US Gulf Coast SWEET

- Light Louisiana Sweet

- WTI Corpus

- WTI Houston

- WTI Nederland

- WTI Echo

US Gulf Coast Sour

- Mars

- Thunderhorse

- Poseidon

- Southern Green Canyon

Canadian Heavy

- Western Canadian Select, Cushing OK

- Cold Lake, U.S. Gulf

- Access Western Blend, Cushing OK

- Access Western Blend, U..S Gulf

- Cold Lake, Patoka IL

Permian

- WTI Midland

- West Texas Sour

- West Texas Light

- WTI Colorado City

- WTI Crane

Cushing

- WTI Ex Basin Pipeline

- Domestic Sweet Cushing Cash Roll

- Niobrara

Bakken

- Light Sweet Guernsey

- Bakken into DAPL pipeline, Johnson’s Corner WY

- Bakken, Paoka IL

- Bakken, Cushing OK

- Bakken U.S. Gulf Coast

Methodology

U.S. domestic physical crude assessments provided by Link Data Services reflect current market prices as viewed from a variety of perspectives and encompassing numerous points of reference. Through interactions with market participants during each trading day, we provide a concise and accurate analysis of volatility, market trends, and comparative crude values. For each U.S. domestic crude grade, we use a systematic approach to arrive at a clear and concise assessment. These methods include, but are not limited to, the following:

Settlement Calculation

- A simple volume-weighted average calculation is used to formulate a settlement price each day

- Trades initiated and completed at Link Crude Resources

- Trades initiated and confirmed on various public exchanges

- Current bids and offers

- Grade Spreads or regrades

- Pipeline transactions and pipeline tariff information

- Other market related data

MOnths Assesed

Each contract is valued for 12 concurrent months beginning with the first nearby contract month and continuing for 12 months. These contracts are also assessed an implied value for each respective quarter for the balance of the calendar year, and then each quarter for the successive calendar year. We will also provide an assessment for two full successive calendar years.

Corrections

Link Data Service, LLC uses its best efforts to compile and maintain accurate market information for the purposes of calculating and publishing a daily market report. In spite of this, there will at times be a need to issue a correction for one or more grade assessments. In the event of a revision, Link will address any concerns related to miscalculations, data-entry errors, clerical mistakes, or incorrect market information. Any published revision will be available within 24 hours of the original assessment.

pricing Basis

Pricing basis differential to WTI Cushing, volume-weighted avg, grade conversions.

Complimentary

Data Portal

All subscribers receive complimentary access to our online Data Portal.

PDF Download

Product Sheet

For more, download our products information sheet.